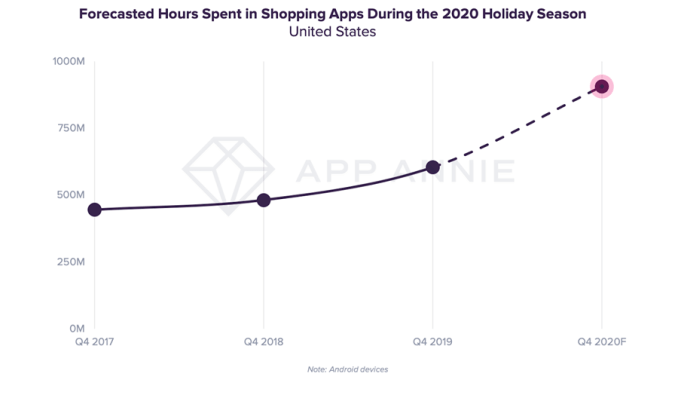

The coronavirus pandemic’s impact on the holiday shopping season is already underway. Amazon has delayed its annual sales event, Prime Day, from July to October 2020, while top e-commerce retailers, including Walmart, Target and Amazon, are becoming more powerful than ever. According to a new report from App Annie, mobile shopping apps are poised to see their biggest shopping season to date. The mobile data and analytics firm is estimating that U.S. consumers will spend more than 1 billion hours on Android devices alone during the fourth quarter, a 50% increase from the same time last year.

This forecast represents a jump ahead for mobile commerce that wasn’t expected until four to six years from now, but the pandemic has pushed that timetable forward.

Image Credits: App Annie

The firm also predicts that the pace of online shopping will look different than in years past.

While, typically, holiday shopping would be concentrated in the weeks around Black Friday and Cyber Monday, it’s expected that the shopping season this year will be longer and more drawn out. To some extent, this could be attributed to Prime Day’s delay, but the economic pressures of the pandemic are also taking their toll.

Heading into the third quarter, unemployment rates in the U.S. were still higher than during the Great Financial Crisis and more than two times higher than pre-COVID rates. App Annie says this will manifest in lower disposable incomes and greater price sensitivity, which will in turn lead consumers to seek out deals and promotions for longer periods of time throughout the lead up to the 2020 holidays.

Prime Day’s delay may also impact the shopping activity that takes place during the normally busy November shopping days, given that the sales event will take place this year much closer to Black Friday and Cyber Monday than ever before.

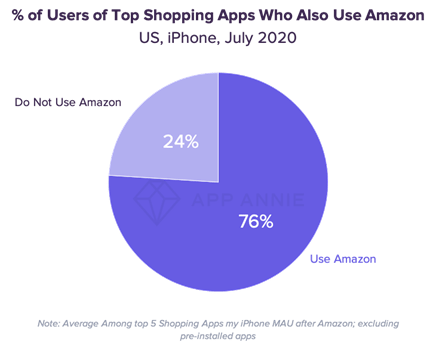

App Annie also noted that Amazon’s app continues to rank No. 1 by monthly active users among U.S. Shopping apps, and sees strong cross-app usage with other top Shopping apps.

Image Credits: App Annie

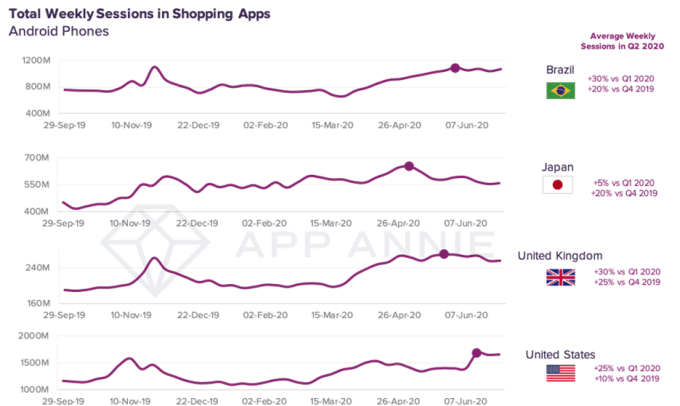

For comparison’s sake, weekly sessions in Shopping apps had grown by 25% during peak weeks during Q4 2019. They were also up 15% in the U.K.

This growth trend will continue as the changes brought on by the pandemic have been built upon existing consumer behavior, which have now been dialed up. Those changes are here to stay, App Annie claims.

Image Credits: App Annie

Related to mobile shopping’s growth, and the more than 1 billion hours spent shopping in Q4 on Android, App Annie also predicts other categories of apps will benefit. PayPal, for example, reported its best quarter ever with total payment volume increasing 29% year over year.

Online grocery services are also booming, particularly in markets with rising COVID-19 cases, like the U.S. and Brazil. Higher usage of mobile grocery shopping apps is expected to continue through Thanksgiving in the U.S., as consumers use apps for checking inventory, self-checkout, delivery and buy online/pickup in store. Similarly, meal delivery services like Uber Eats, DoorDash and Grubhub are also expected to remain valuable and widely used in Q4.

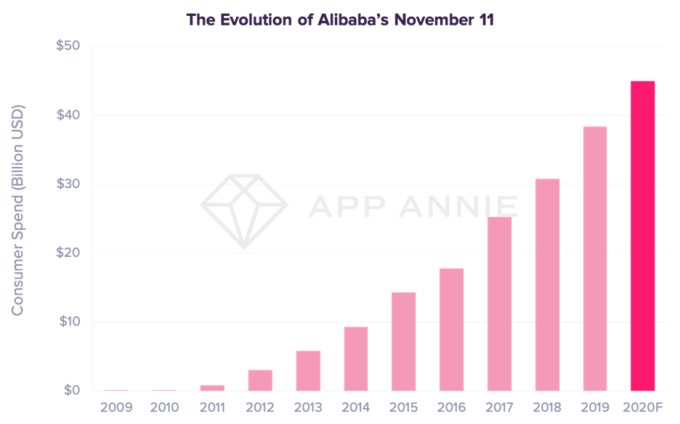

Image Credits: App Annie

Outside the U.S., App Annie forecasts that Singles Day 2020 will bring in more than 310 billion CNY (over $45 billion in U.S. dollars) to make it the biggest shopping day ever. This will top last year’s record of $38 billion in sales, and follows Q3 2020’s 4.8% year-over-year retail sales growth in China.

Recent Comments