Your startup must be this ‘good’ to ride

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

The crew at Bessemer released their new, yearly cloud report this week. It’s a useful lens into how venture capitalists are thinking about cloud and SaaS startup performance metrics. Bessemer’s cloud and SaaS exits include Twilio, Shopify, PagerDuty, Box, and a few others, so they’re worth listening to at least a little on the topic.

I bring all this up as I finally got the chance to read the 2020 report (here, if you want to dig through it yourself, and here’s the 2019 version for reference). I’m going to chat with Bessemer’s Mary D’Onofrio about some numbers from the presentation next week, but this morning I wanted to discuss the report’s SaaS and cloud startup scorecard.

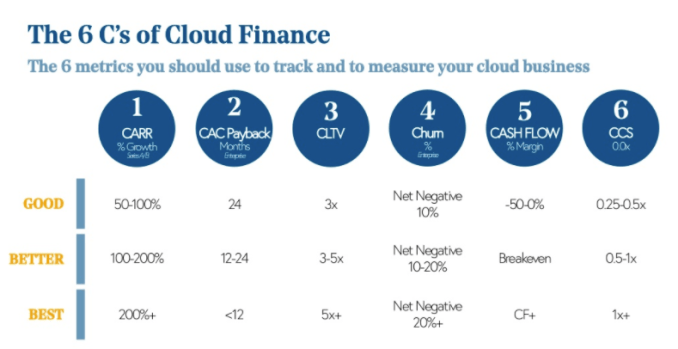

Bessemer likes to invent metrics, something that I approve of. In 2019, the firm debuted a G.R.I.T (“ARR growth, retention, years of runway, and efficiency”) score that was a bit complicated. This year the report included a six metric rundown of “good, better, and best” startup cloud and SaaS startup performance.

Let’s chew over the set of SaaS metrics that investors, before COVID-19, were looking for. Next week we’ll find out if Bessemer has changed any of them in light of the new economic collapse cum malaise.

Grow this fast, lose this much

TechCrunch has a general rule against screenshots of text, but today there’s no way around it. Here’s the pertinent summary slide from the Bessemer report:

Recent Comments