The coronavirus pandemic has presented plenty of challenges for ad-reliant social networks, but Snap made clear it was not yet feeling significant negative effects with its Q1 earnings release today.

Snap surged 17% after-hours on news of its Q1 results after dropping nearly 4% during trading today. The company reported revenue of $462 million in line with precious guidance and besting Wall Street’s tempered expectations around $430 million. EPS was -$0.08, slightly worse than analyst expectations of a 7-cent loss.

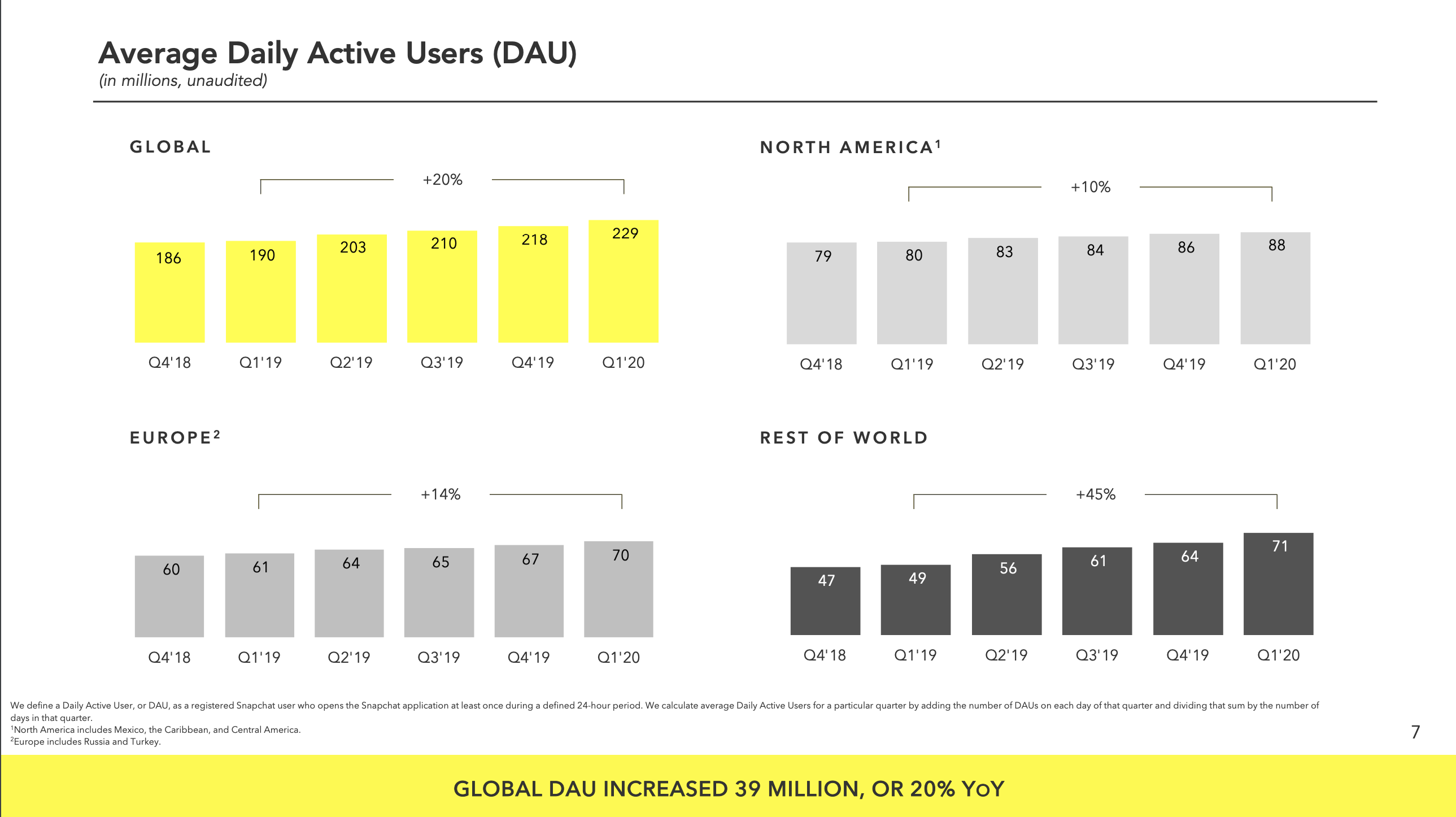

Daily active users reached 229 million in the first-quarter, representing a 20% year-over-year gain, higher than the 224.5 million users that had been expected. Another interesting tidbit from the release was the 35% year-over-year growth in daily time spent watching content in Discover.

“Snapchat is helping people stay close to their friends and family while they are separated physically, and I am proud of our team for overcoming the many challenges of working from home during this time while we continue to grow our business and support those who are impacted by COVID-19,” CEO Evan Spiegel said in a statement accompanying the release.

2019 was a redemptive year for the social media company, which had seen steady declines in its share price since entering public markets. Since its last earnings release in early February, Snap’s stock price has dropped more than 30%, echoing similar declines seen by other social media companies in the midst of a broader market plunge.

A positive Q1 earnings report is welcome news for the downward-trending stock.

The full impacts of COVID-19 will be fully evident in the second-quarter filings, as Q1 includes financial performance in a February and early March which were much less impacted by pandemic fallout on the broader digital ad market.

This was a relatively quiet quarter for Snap in terms of product updates. Late last month, the company announced that it would be enabling Stories syndication to other apps as the company aims to make its developer platform more attractive to third-parties.

We’ll be updating with more information from the investor call.

Recent Comments